1. Document Verification

- Identity Document Auto-Capture

- AI-Powered OCR & Automated ID Classification

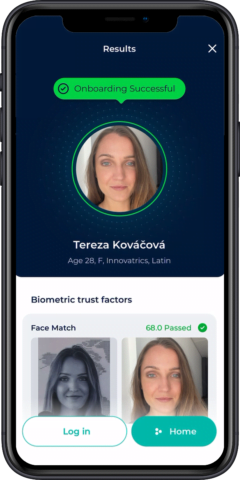

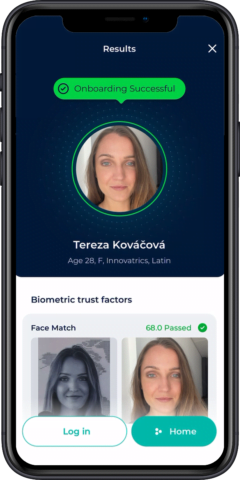

- Biometric Verification & Data Consistency Check

- Document Authenticity Validation

Innovatrics Digital Onboarding Toolkit (DOT) is a full technology stack for developing remote identity verification applications. DOT’s components include NIST FRVT top-ranked facial biometrics, identity document verification, and iBeta Level 2 accredited liveness detection. Each component is developed in-house and well-documented for easy integration.

Digital Onboarding Toolkit allows the storage & management of customer biometric data for authentication and identity fraud prevention. Our technology has been successfully deployed in large-scale, mission-critical biometric solutions for governments and enterprises around the world.

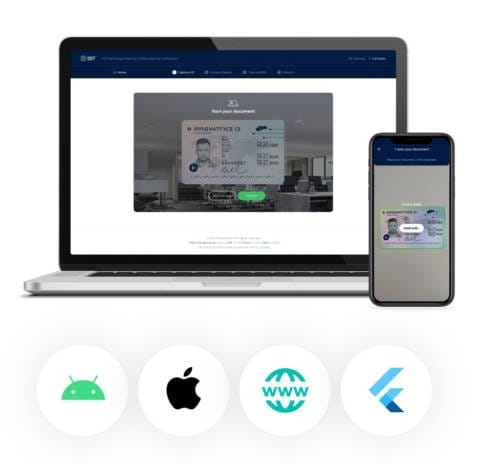

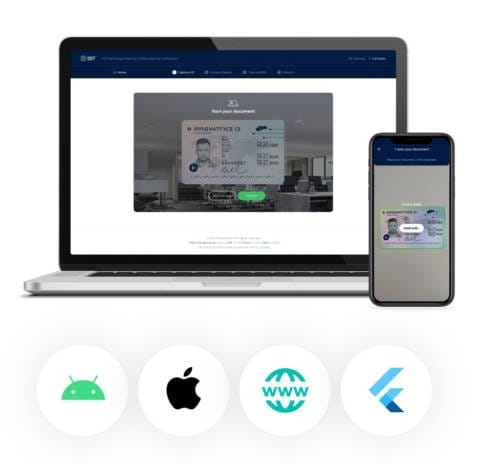

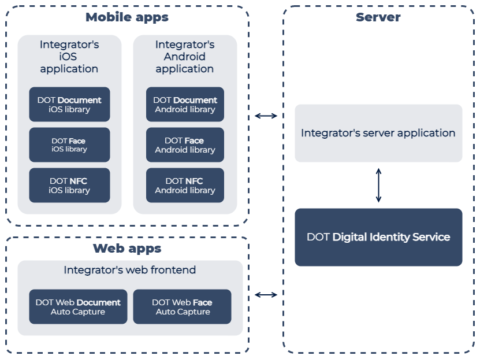

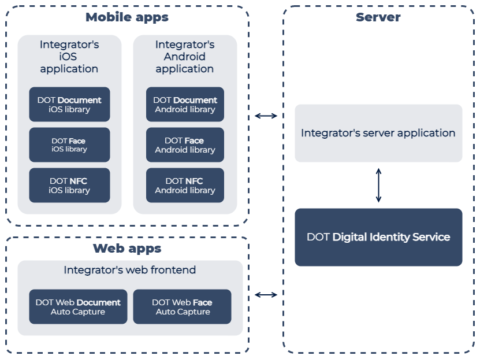

Digital Onboarding Toolkit offers a complete set of server and client components with well-documented API allowing easy integration into native mobile apps (iOS and Android), cross-platform apps (Flutter) as well as web applications, even if you don’t have experience with biometrics.

Innovatrics’ industry-leading facial liveness detection is based on deep neural networks to detect and prevent remote identity verification frauds. Verified by iBeta, it is compliant with ISO 30107-3 Level 2 Presentation Attack Detection (PAD) testing.

Learn more

To make integration of our identity verification components as easy as possible, we’ve launched our DOT Developer Portal. This resource center gives you a step-by-step overview of how to quickly and efficiently integrate remote identity verification capabilities into your solutions.

With remote identity verification API available in the cloud, you can now integrate top-tier biometrics and industry-proven technology into your applications with faster time to market minus the associated server infrastructure costs.

See documentation

Consistently among the fastest and most accurate in NIST FRVT benchmarks, our face recognition algorithms have been deployed in some of the largest biometric projects in the world. With our own R&D Center and close cooperation with universities and research institutions, you have immediate access to innovations that are at the forefront of biometric research and technology.

FRVT | NISTThrough our Innovatrics Partner Program, you can enhance your portfolio using our proprietary facial recognition and digital onboarding technology. Get direct access to practical marketing tools, demo products, technical documentation, and training. We help our approved partners build identity verification solutions that nurture their business and customers.

We have successfully partnered with organizations belonging to telco, finance, and banking to add remote customer onboarding solutions among their services. Whatever your business may be, you can also benefit from remote identity verification.

Become our partner

Verify and register customers remotely via mobile app or web using Digital Onboarding Toolkit. Our facial recognition technology makes it a reliable biometric registration system for the banking and financial sector.

Digital Onboarding Toolkit will verify your users’ identity not only upon sign-up to your services but every time they log in to their account. The whole process is paperless and completely online.

Onboard new customers and activate services remotely while complying with regulatory demands for reliable identity verification.

Activate policies, authenticate clients, and process claims securely while protecting your organisation from identity fraud.

Verify the identity and age of the gamers to comply with regulatory requirements and prevent online gaming fraud.

Establish seamless and entirely digital citizen journeys with reliable biometric identification. Thanks to remote identity verification, services like document issuance are more secure, reliable, and accessible directly through citizen smartphones.

Full Technology Stack for Online Identity Verification

Download Datasheet