Let’s Talk

Our experts will be more than happy to discuss how biometrics can contribute to your business goals.

Contact UsFrictionless Remote Identity Verification to Secure Your Business

Coupled with the rising incidence of identity theft and fraud, adopting a secure and seamless remote customer onboarding is mission-critical for banks, financial service providers and telco companies.

Innovatrics remote identity verification is designed to improve customer experience, increase conversion rates and prevent identity fraud at the same time.

Without reliable identity fraud prevention measures in place, fraudsters can misuse or fake one’s identity. Make sure users are who they claim to be with our remote identity verification.

Prevent your business from being connected with money laundering and financial crimes caused by fraudulent account holders.

Protect your credit portfolio with highly secure identity fraud detection and reject fraudsters getting consumer loans approved.

Don’t let your reputation be compromised. Stop subscription fraud before it happens and protect your clients from SIM swap fraud.

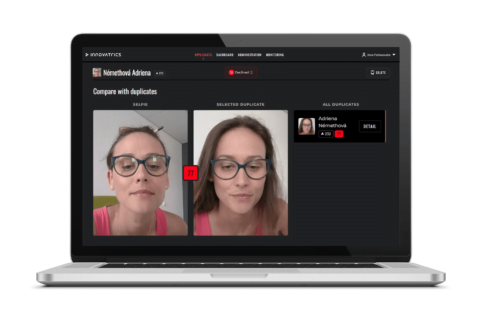

Innovatrics Digital Onboarding Toolkit offers high-performing and lightweight online identity verification for your web and mobile apps. In two simple steps, our technology verifies if the person being onboarded is who they claim to be. Our Trust Platform adds an extra layer of security as it prevents duplicate records.

To prevent identity theft using stolen, lost, or synthesized identity documents, the components of our Digital Onboarding Toolkit help you detect fraudulent attempts:

Fraudsters use various methods of presentation attacks to make you believe they are somebody else. Leveraging in-house R&D, our algorithm can detect any spoof, whether a paper or a 3D mask, a photo or a video on the screen, or even a lifelike doll.

Especially in the finance field, fraudsters repeatedly apply for loans with different ID cards. To protect your business from this type of identity fraud, performing biometric deduplication (1:N) during the remote onboarding process can be highly effective.

When expanding its global presence, Home Credit, a global consumer finance provider, teamed up with Innovatrics to build up a user-friendly and secure digital onboarding solution.

Innovatrics remote identity verification technology, combined with biometric deduplication, helped Home Credit reach 99% completion rates of their onboardings and 98% repayment rates of provided loans.

Learn more in Home Credit case study

Our experts will be more than happy to discuss how biometrics can contribute to your business goals.

Contact Us