Digital Onboarding Enables Online Broker to Reach Millions of Clients

CEE | EnterpriseSituation

With international expansion a priority, Finax teams up with Innovatrics to create a simple, smart, and secure solution to invest in exchange-traded funds (ETFs). As a result, it holds the distinction of being the first broker in Europe to launch online biometric identity verification using Digital Onboarding Toolkit (DOT).

Online securities broker, Finax, offers a simple and affordable means of investing in ETFs of major stock markets by leveraging computing power and big data. The onboarding process was manually performed, where staff had to compare pictures of IDs and selfies and then review bank statements before accepting a new investment client. Although a prudent approach, it was very difficult to scale if the business was to significantly expand.

Challenge

What Finax needed was an automated paperless way to onboard new customers online while fully complying with know your customer (KYC) protocols and anti-money laundering (AML) regulations. If the business were to expand internationally, it would have to adapt full automation of its onboarding process – a tremendous leap from manual identity verification.

A comprehensive solution was needed to seamlessly onboard clients online and provide all the necessary components to minimize identity fraud while being compliant with KYC/AML regulations.

Our Solution

Innovatrics Digital Onboarding Toolkit (DOT) was implemented and integrated into the Finax webpage. Because of the open architecture of the platform with a well-documented application programming interface (API) to boot, the hassle-free integration was carried out in-house by Finax themselves, requiring minimum support from the Innovatrics team. To open an account, a prospective client has to go through three steps for identity verification:

- First, the client takes a selfie via the webcam or phone camera.

- The next step is taking a picture of a valid ID document. The AI-based OCR in DOT ascertains the accuracy of the information on the ID, which is easily capable of learning new languages crucial to international expansion.

Our NIST-topping face recognition algorithm compares the photograph on the ID with the selfie and verifies the identity with the highest degree of precision. It estimates the age and gender from the selfie, reads the issue date of the ID, and reviews the age difference. It also compares the machine-readable zone of the ID with the customer data to prevent possible tampering.

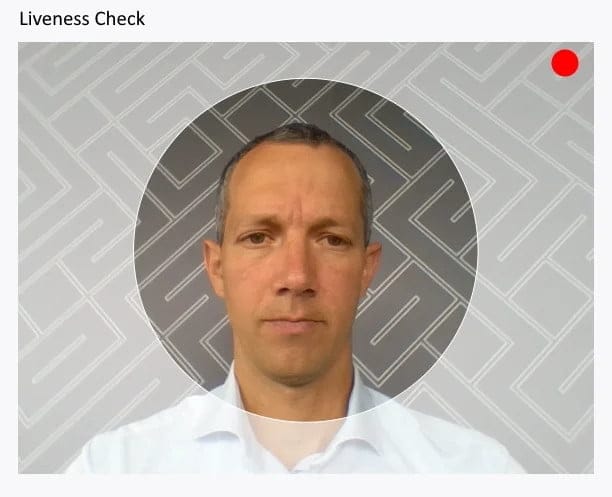

- Lastly, liveness check is performed by following a randomly moving dot on the screen for correct eye movement to eliminate the possibility of fraud. During this stage, face verification is carried out once again for added security.

After successfully passing all three steps, the customer is enrolled. No paperwork is necessary, and the company has met all regulatory requirements.

Furthermore, the full customizability of DOT allows Finax to adapt all of their services to each individual market.

Result

With Innovatrics Digital Onboarding Toolkit in place, Finax can securely onboard clients remotely while meeting KYC and AML regulations. Consequently, their web-based approach makes it easy to deploy upgrades while having the whole process under control.

Based on their findings, the onboarding process is now 40 to 50 percent faster than before with 70 % of all their customers digitally onboarded. For clients 45 years old and below, the figure is even higher at 75%. With the forthcoming integration of DOT into iOS, that percentage is expected to further increase.

The implementation of DOT is instrumental in Finax’ strategic target of reaching 150 million potential customers in the European Union and the rest of the world in the coming years.