Innovatrics has successfully passed iBeta Level 2 Presentation Attack Detection (PAD) conformance testing of its fully on-device passive liveness check.

Innovatrics is one of the very few companies in the world that offer iBeta Level 2 passive liveness detection that works fully on user’s device without the need to send any personal data to a server.

After passing iBeta Level 1 tests last year without a single error, Innovatrics has succeeded in the next level of tests. Unlike iBeta Level 1, which focuses on simpler attempts at spoofing liveness detection algorithms, Level 2 is designed to protect against more sophisticated attacks, such as those with 3D masks. iBeta conducts these tests in accordance with the ISO/IEC 30107-3 standard and in alignment with the ISO/IEC 30107-1 framework for presentation attack detection (PAD).

“We’re very happy to see that our algorithm is able to tackle ever more challenging scenarios of presentation attacks with 100% accuracy.”

Head of Product Management at Innovatrics, Daniel Ferak

100% Performance on iBeta Level 2 Testing, Completely On-Device

Innovatrics passive liveness check is able to run completely on a user’s device without any data exchange with the server and a 1-second response time. Innovatrics is one of the first from a handful of companies to offer such technology fully offline with iBeta Level 2 compliance.

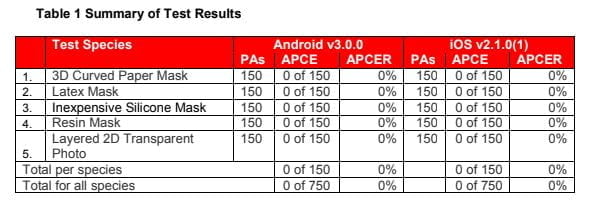

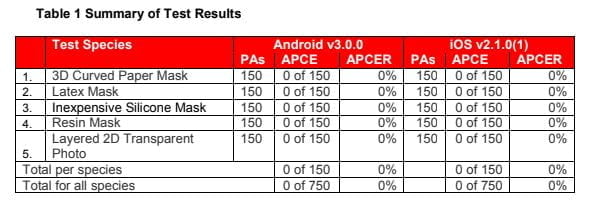

Our submission has attained the highest possible level of accuracy in Level 2 testing, correctly detecting all 1,500 attempted spoofs and accepting all of the genuine logins. Simply put, it accepts 0% of presentation attacks and doesn’t mistakenly reject anyone who is indeed present.

Innovatrics’ research team in Brno, Czech Republic has developed the liveness check algorithm by applying the latest approaches in computer vision and machine learning.

The technology is part of Digital Onboarding Toolkit, a set of modules that provide facial recognition and verification, liveness check and AI-driven OCR for automatic document reading for complex, secure and flexible remote onboarding via app or web interface. It provides KYC capabilities for financial, telecommunications and other sectors that require reliable and convenient way for customers to access their services remotely.